How to Read Mental Health Eligibility Verification Data

Working with insurance can often be one of the most frustrating aspects of mental health practice. Even when you think you have submitted all necessary information and paperwork, you still may face claims denials. As a mental health provider, you may even feel wary of taking on new clients due to potential issues with insurance and denied claims.

Luckily, many of the most common reasons for mental health claims denials can be avoided with some preparation and understanding of how to read and analyze mental health eligibility verification data.

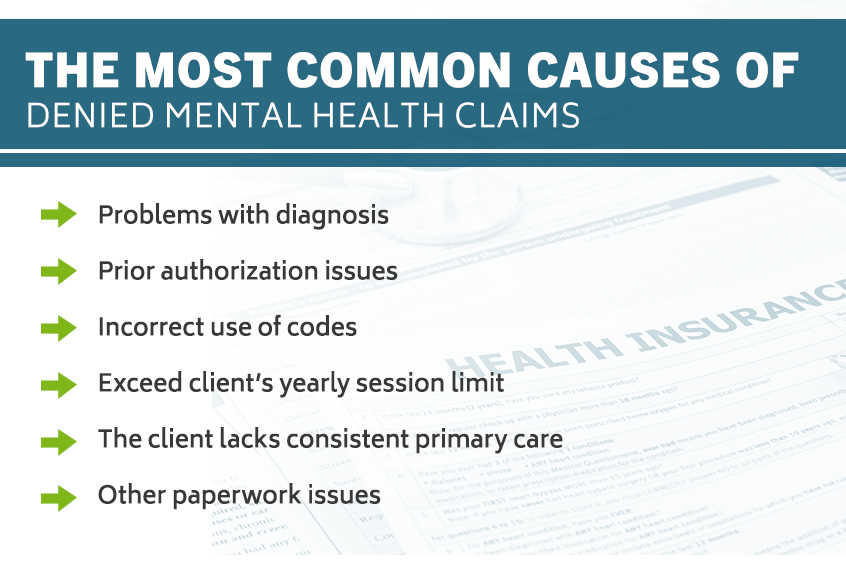

The Most Common Causes Of Denied Mental Health Claims

There are a few common reasons that may cause an insurance company to deny mental health claims. Understanding some of those reasons is a good first step to avoid claims denials in the future. While insurance companies’ reasoning may often feel opaque, some of the most common causes include, but are not limited to, the following:

- Problems with diagnosis: Clinicians and other mental health providers may encounter insurance problems simply due to incorrect or incomplete diagnosis codes. This especially applies to the use of any ICD-9 diagnoses. In general, most insurance claims require five digits, though in some cases, a diagnosis may only consist of three or four digits. Check all of your diagnosis codes against the official database to ensure their accuracy.

- Prior authorization issues: Prior authorization, sometimes called “pre-authorization,” refers to any instance in which the insurance company requires notice from a provider’s office before agreeing to cover some or all of the cost of service and/or medication prescribed. Prior authorization, as a practice, is not as common as it once was. However, some insurance plans still require prior auths, and failure to secure one may result in a delayed or denied claim. Prior authorizations most commonly apply to prescriptions but may also extend to therapy services. Completing a prior authorization generally requires the provider to give the insurance company a significant amount of documentation.

- Incorrect use of codes: If you use CPT codes, these codes can be a stumbling block for insurance approval. You may inadvertently use a CPT code that the client’s insurance plan does not cover, a code that was not authorized or an out-of-date code. Keep in mind this also applies to “Place of Service” (POS) codes, which are not always intuitive. For example, the code for office is not “O” or “OFF” but “11.” Making an error with one or more of these coding issues can contribute to an eventual denial of mental health claims.

- Exceed client’s yearly session limit: Some insurance plans may limit the number of yearly sessions that a client may receive. This is often especially true of insurance plans that require prior authorization. It’s important to keep in mind that a “year,” according to an insurance plan, does not always correspond to the calendar year.

- The client lacks consistent primary care: Some insurance companies will require that clients receive documented, regular care from their primary care physician before covering the costs of mental health treatments or medications. In general, this most often applies to situations in which the mental health practitioner is not a physician themselves.

- Other paperwork issues: There are several other common paperwork issues that may cause mental health claims denial. These issues can include filing the claim too late, using the incorrect claim form, completing claims forms in a manner illegible or incomplete and sending claims to the wrong address.

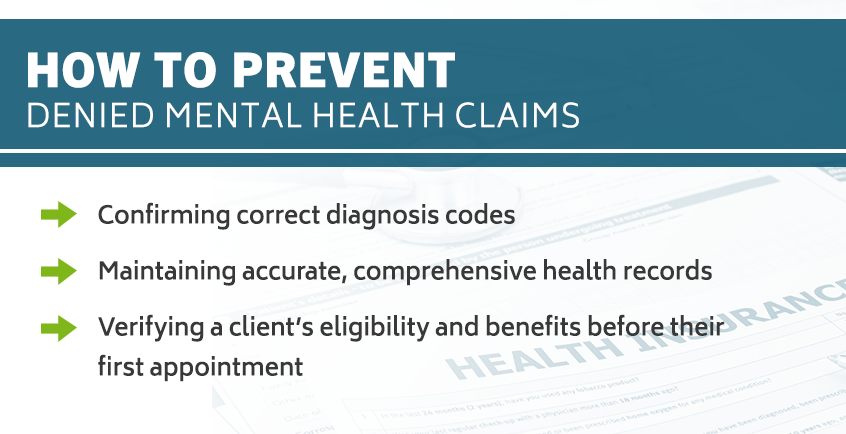

How To Prevent Denied Mental Health Claims

By avoiding denied mental health claims as a provider, you can ensure your clients will not experience any disruption in their care due to insurance or financial reasons. Avoiding these denials is also key to ensuring that you, the provider, receive timely and complete payments. Thankfully, many common causes of denial of mental health claims can be avoided. There are a few steps that you can take to limit the possibility of denied claims as much as possible.

These steps can include:

- Confirming correct diagnosis codes: Before submitting any paperwork to the insurance companies, be fastidious with the accuracy of diagnosis codes, CPT codes, POS codes and any other applicable codes. This attention to detail will likely save you both time and stress in the long run and help you to avoid a claim denial.

- Maintaining accurate, comprehensive health records: When you take a new client, it’s crucial you obtain, and then maintain, a comprehensive health record for them. This includes all session notes, insurance cards, personal identification, notes from any previous mental health treatment, a list of current and prior medications, payment methods and general medical history, among others. You may need some or all of this documentation to respond to prior authorizations and other insurance requests.

- Verifying a client’s eligibility and benefits before their first appointment: Mental health insurance verification is one of the first things you should do before taking on a new client. Establishing a client’s coverage and benefits before beginning care is a responsibility that providers owe their clients. By doing so, you ensure your treatment is covered. Or, if it is not covered, you will avoid beginning treatment with a client that you cannot continue seeing.

Information to Have Prepared Before Calling

Most experts agree that the best, easiest and most accurate way to obtain mental health insurance verification is to contact a client’s insurance company directly. Typically, it is recommended that you, the provider, call the insurance company's claims office.

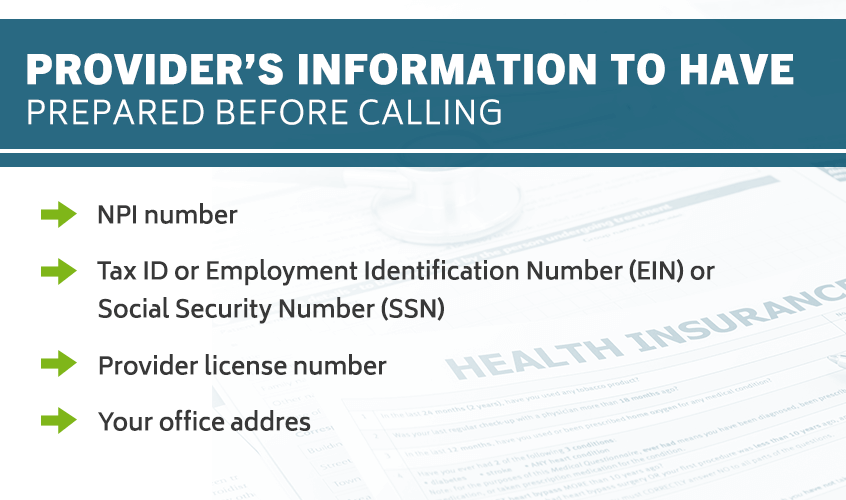

Before you call the insurance company, there are some important documents and other pieces of information you will likely need to confirm insurance verification. The information you need to prepare will include details about your own status as a provider, as well as the client’s general identification and insurance information.

Provider’s information might include the following:

- NPI number: Your National Provider Identifier (NPI) is a 10-digit number used to verify your unique identity as a healthcare provider. Insurance companies will need you to provide this to complete any insurance verification requests.

- Tax ID or Employment Identification Number (EIN) or Social Security Number (SSN): While this information is delicate and you may feel highly protective of it, you will almost certainly need to provide your tax ID, EIN or SSN to obtain insurance verification.

- Provider license number: Insurance companies will not often request your license number. Nevertheless, there is a small chance that they might, so it’s a good idea to have it readily accessible should you be asked to provide it.

- Your office address: Insurance companies may also expect you to provide your address of service — essentially, the mailing address for the place where you see clients, be that a hospital, office, wellness center, university or other location.

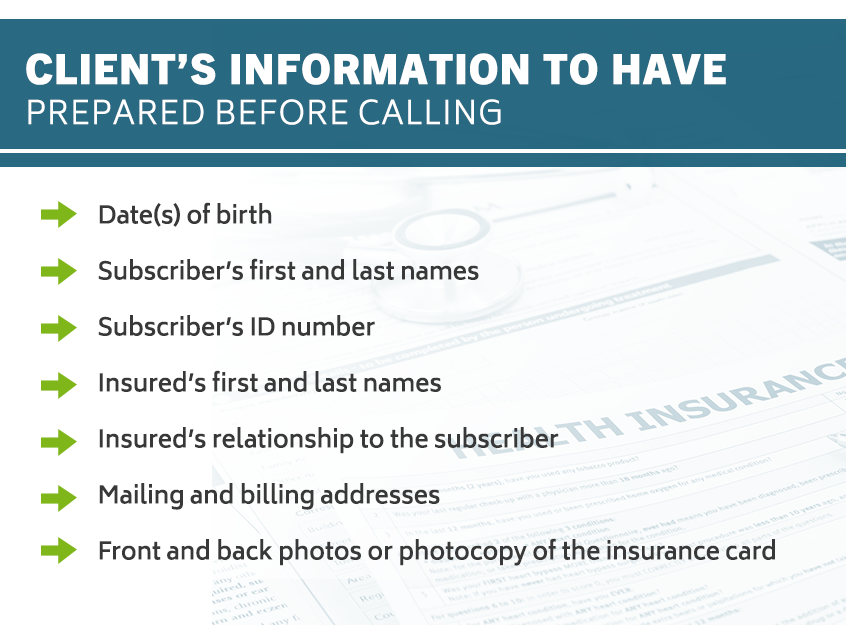

The client’s information should include:

- Date(s) of birth: You will need to provide your client’s date of birth. If your client is not the subscriber on the insurance plan, you may need the subscriber's birthdate as well.

- Subscriber’s first and last names: The title “subscriber” refers to the person who is the primary holder of the insurance plan. This person may be your client, or your client may be one of the subscriber’s dependents. Verify correct spelling beforehand.

- Subscriber’s ID number: This ID number is typically listed on the front of the insurance card. In most cases, it is a combination of numbers and letters.

- Insured’s first and last names: If your client is not the subscriber but is simply the insured party, you will need to provide their full name, spelled correctly.

- Insured’s relationship to the subscriber: Common subscriber-insured relationships include spouse or child. Often, this relationship is listed on the insurance card, but sometimes it is not. Verify this relationship with your client beforehand.

- Mailing and billing addresses: Having the wrong mailing and billing address is infamously problematic when it comes to verifying with an insurance company. A small misspelling or one number wrong in the zip code can cause claims delays and denials.

- Front and back photos or photocopy of the insurance card: It’s always a good idea for you to obtain up-to-date copies of all of your clients’ insurance cards. Insurance cards contain nearly all relevant information that you — and your clients — will need to contact the insurance company or pharmacy throughout their treatment period.

Questions to Ask When Verifying Insurance Benefits

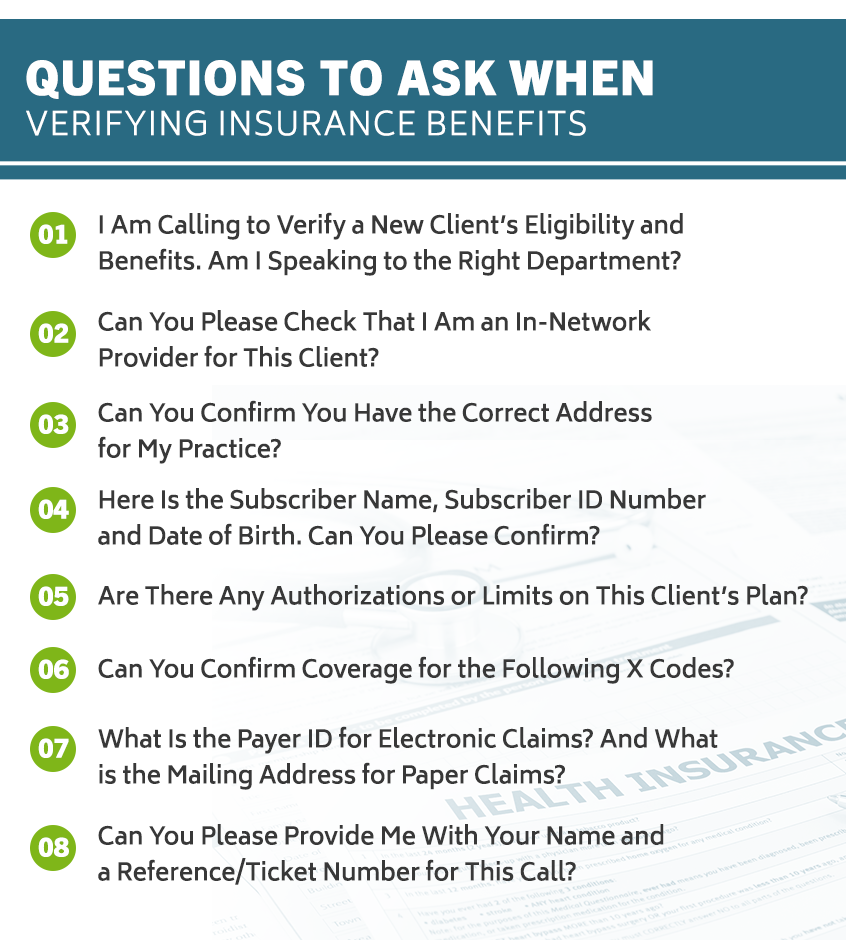

It’s best to be highly prepared with all information and paperwork before reaching out to a client’s insurance company. You may find it helpful to compile some questions before making the phone call. You can even use these questions to easily build a script for your phone call to ensure, as much as possible, that your insurance filing will be accepted. Some of the most helpful questions include the following:

1. I Am Calling to Verify a New Client’s Eligibility and Benefits. Am I Speaking to the Right Department?

It’s important to confirm you have reached the correct department of the insurance company. This will save you from having to explain your purpose and information to multiple people and may help to streamline the entire process.

2. Can You Please Check That I Am an In-Network Provider for This Client?

This should be the first question that you ask once you determine that you’ve connected with the eligibility and verification department. If the answer to this question is an automatic “no,” then you’ve already gotten the information you need.

3. Can You Confirm You Have the Correct Address for My Practice?

The accuracy of this information is critical for billing and payment needs.

4. Here Is the Subscriber Name, Subscriber ID Number and Date of Birth. Can You Please Confirm?

If your client is not the subscriber but is a dependent — an “insured” party — you will need to provide your client’s name, date of birth and relationship to the subscriber as well.

5. Are There Any Authorizations or Limits on This Client’s Plan?

Gleaning this information will be important if you continue to provide care to the client in question. Prior authorizations or session limits don’t have to pose a significant problem, as long as you are aware of them and can prepare accordingly.

6. Can You Confirm Coverage for the Following X Codes?

At this point, you can share any CPT codes or other diagnostic codes you use for your clients. By establishing coverage of these codes with the insurance plan, you’ll be better equipped for treatment and paperwork regarding this client throughout their treatment.

7. What Is the Payer ID for Electronic Claims? And What is the Mailing Address for Paper Claims?

Whether you file your insurance claims electronically or through the mail, it’s important to confirm you have the correct information for the insurance company and plan in question. This can help you to avoid delayed verifications and even delayed payments.

8. Can You Please Provide Me With Your Name and a Reference/Ticket Number for This Call?

Asking this question is a simple way for you to protect yourself from any pushback or miscommunications you may encounter from the insurance company in the future. Some insurance companies record their calls for quality assurance and general record-keeping — being able to refer back to all of your interactions with an insurance company can be helpful.

ICANotes Specializes In EHR for All Behavioral Health Specialities

As a mental health provider, your top priority will always be your clients' health, safety and care. Due to the increasingly complex nature of modern healthcare administration and billing, you may find yourself spending more and more time on paperwork and less time on treatment plans for your clients.

ICANotes offers comprehensive, innovative EHR solutions to help eliminate the time and stress often caused by healthcare paperwork and health records. With over twenty years of experience, ICANotes is a proven leader in the field of EHR, and this expertise is invaluable creating quality, effective healthcare solutions. All of ICANotes’ EHR products are specifically designed and built with behavioral health specialties in mind. As such, behavioral health practitioners can feel confident integrating ICANotes into their practice. Unlike other EHR software, ICANotes is the only provider that offers 100% fully-templated EHR.

ICANotes can be an invaluable tool for mental health providers. Innovative EHR solutions include charting, electronic prescribing, scheduling, billing, document management, secure messaging features and even a patient portal. Practitioners, clinicians and administrative staff can feel confident while using ICANotes EHR, as we greatly value the safety and privacy of both patients and healthcare providers. Using a highly intuitive, user-friendly design, ICANotes requires minimal training and can be ready for minutes after it is out of the box.

Developed by clinicians with a first-hand understanding of the needs and challenges of the behavioral health field, ICANotes is the premier choice for EHR in the field. Reserve a time for a live demo today.

Related Posts

Mental Health Billing Tips for 2021

Billing Pitfalls for Mental Health Clinicians

What Is a BillFlash Statement?

What Is the Difference Between a Clearinghouse Rejection and a Payer Denial?

CPT Code Basics: What You Should Know

Mental & Behavioral Healthcare Billing: How to Maximize Your Reimbursement Rate