What Providers Need to Know About Out of Network Reimbursement

An out of network provider is a clinician who has not signed a contract with a certain insurance plan to provide behavioral health or healthcare services for their members, which directly impacts out of network reimbursement. Being out of network can raise some concerns regarding insurance and practices.

If you are considered an out of network provider, there are several essential aspects of insurance you need to understand. Learn why insurance providers want you to join their network, the benefits of being in network versus out of network, how being out of network can affect your business, and understand important concepts like courtesy billing and the No Surprises Act.

Table of Contents

- Do You Have to Sign up to Be Out of Network?

- Why Insurance Providers Want You to Join Their Network

- The Benefits of Being In-Network

- Being Transparent With Patients About Being Out of Network

- How Being Out of Network Affects Your Business

- What Is Courtesy Billing?

- Out of Network and W-9s

- The No Surprises Act

- Other FAQs

Do You Have to Sign Up to Be Out of Network?

Typically, a provider does not have to sign up to be out of network. You are automatically an out of network provider if you do not sign a contract with an insurance plan, so no additional steps are needed on your part to be out of network. However, some insurance plans require you to register as an out of network provider.

Why Insurance Providers Want You to Join Their Network

Insurance providers want you to join their network for two reasons — they can ensure you meet their quality standards and pay you a prearranged rate for services. Insurance providers want to be able to control and predict costs, and they do so by maintaining a network of providers.

However, being an in-network provider can mean that you accept a reduced payment, and you may face restrictions or requirements to be an in-network provider. On the other hand, an insurance company may discourage members from going to out of network providers and incentivize visits to in-network providers. Ultimately, you should consider the pros and cons of being an in-network clinician or an out of network clinician before determining which is the right option for you.

The Benefits of Being In-Network

If you choose to be an in-network provider, you may enjoy the following benefits:

- Automated marketing: Being an in-network provider provides automated marketing because members will search their insurance plan's database for preferred providers. Being part of an insurance plan's database can improve your visibility to potential clients. The more networks you belong to, the more organic client leads you can potentially receive.

- More affordable for clients: Clients using in-network benefits can typically enjoy reduced costs. Greater affordability can mean your clients are more likely to return for repeat sessions.

- Larger client pool: Since being an in-network provider can make your services more affordable for clients, you may have access to a larger pool of potential clients. Other providers may also refer clients to your practice if you belong to the same insurance network.

Download our free Mental Health Billing Guide

The Benefits of Being an Out of Network Provider

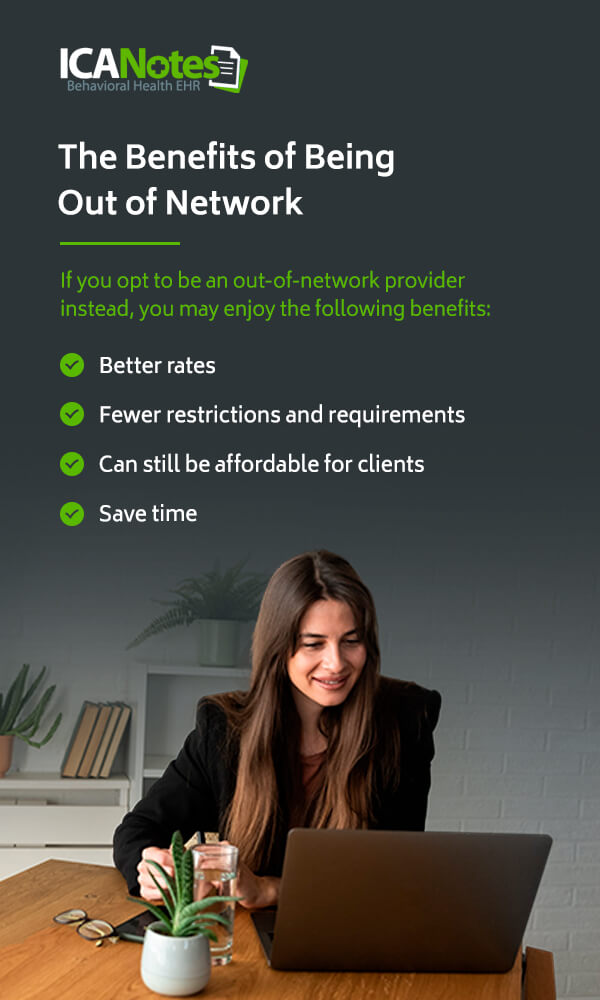

If you opt to be an out of network provider instead, you may enjoy the following benefits:

- Better rates: When you choose to remain an out of network provider, you may be able to set higher rates than you would as an in-network provider.

- Fewer restrictions and requirements: There is greater freedom when you choose to be an out of network provider, as there are often restrictions and requirements for in-network providers to remain in an insurance provider's network.

- Can still be affordable for clients: Going to an out of network provider can still be affordable for clients, especially if they have some coverage for out of network reimbursement. Depending on their insurance plan, an in-network provider can still be expensive to visit between copays, coinsurance and deductibles.

- Save time: Applying to be an in-network provider can take time — and can be a waste of time if the insurance company rejects your application. Additionally, making an in-network claim can be a lengthy process due to all the insurer requirements, meaning remaining out of network may save you time.

Being Transparent With Patients About Being Out of Network

You should be transparent with your patients about being out of network. Your patients need to understand the implications and what the costs for their behavioral health treatment could be as a result. Be clear with your patients about your fees and how the payment process works. For example, let your clients know if payment is due in full at the time of the service or if you will bill their insurance plan first and then charge them the remainder.

Let your clients know if you are open to helping them apply for out of network reimbursement from their insurance plan. Helping your clients with their insurance can help them afford your services and help you retain patients. In some states, an ethical code may require you to help clients with third-party providers, so be sure to give your clients all the information they need about this process.

How Being Out of Network Affects Your Business

You can lose new clients when they discover you are an out of network provider, which can negatively impact your business. To help combat the loss of new clients, you can offer to contact the potential client's insurance plan about their out of network reimbursement coverage. In this case, the potential client should give you the information off their insurance card, and you can call their insurance plan and let the client know about their out-of-network coverage.

For example, even if you are not an in-network provider, the client may still be eligible for some out of network reimbursement that covers a percentage of their costs and makes treatment affordable. If the potential client has a deductible, you can let them know how that would factor into their costs. Taking this step can get you a new client, ensure affordable care for them and demonstrate that you care about their health, which can lead to a long-lasting clinician-patient relationship.

Today, it can be difficult for clients to find in-network therapists, so the next best option is often an out of network provider with whom a client can still get receive some out of network reimbursement. If you build a connection with a potential client over the phone, and they cannot find a therapist in their network, they may return to you because of the care you demonstrated. If you are actively trying to fill slots in your practice, taking this step can be well worth your time.

What is Courtesy Billing?

Courtesy billing is a less risky billing method in which your client pays you upfront, but you submit the bill to your client's insurance plan on their behalf as a courtesy to your client. The insurance company will then reimburse the client as they would have if the client had submitted the bill themselves.

In the behavioral health field, this can eliminate an administrative burden for clients already struggling with anxiety, depression or other mental health issues. Additionally, you can ensure you still get paid in full and don't take on any financial risk. Though this means additional time spent on administrative tasks for you or your staff, courtesy billing can attract new clients or retain existing clients who may be struggling with the billing process.

Out of Network and W-9s

If you are an out of network provider, your client's insurance plan may request a W-9 form before they provide reimbursement. Since you are not an in-network provider with that insurance plan, they are not familiar with your information, such as your tax ID number or National Provider Identifier (NPI). A W-9 confirms that you are a clinician and verifies your information with your signature. The insurance plan can then add your information into their system.

You can print and complete the W-9 form or fill it out online. The insurance plan may request that you or your client submit the form, so be sure to note the plan's instructions. Completing a W-9 form is simple and free and will ensure your client receives out of network reimbursement.

The No Surprises Act

The 2021 No Surprises Act protects consumers from surprise medical bills. This act most likely applies to your services, so it's crucial to understand this new law as an out of network provider and ensure you comply. For example, you must inform your clients that out-of-network care could be more costly and offer options that could help clients avoid balance bills. Watch our on-demand webinar to learn more about the No Surprises Act. ICANotes simplifies the process of providing clients with a good faith estimate as required by the No Surprises Act. We have a built-in good faith estimate form. Book a demo and one of our product experts will show you how it works.

Other FAQs

Here are some frequently asked questions we receive regarding out of network providers and insurance reimbursement.

1. Does Every Client With Health Insurance Have Some Coverage?

Depending on the health insurance plan, some clients will have out-of-network coverage, and some will not. Health maintenance organization (HMO) plans and exclusive provider organization (EPO) plans only cover in-network providers. If you are not an in-network provider with a certain insurance company and a client has an HMO or EPO through that company, they will not have any coverage for your services as an out of network provider.

However, clients with preferred provider organization (PPO) plans or point-of-service (POS) plans receive coverage for both in-network and out of network providers. All this means for a client is that they may pay more when they go out of network, but they will still have some coverage and can receive out of network reimbursement.

2. How Does Out-of-Network Insurance Billing Work?

Ideally, the client will pay an out of network provider in full at the time of the session. However, some out of network providers opt to bill clients periodically, such as at the end of the month. If you are an out of network provider, you can give your client a superbill after receiving full payment. A superbill reflects that the client did pay you for the services. A superbill should include the following information:

- Your name

- Your contact information

- The date of the invoice

- The client name

- The client's date of birth

- The diagnosis codes

- The place of service code

- The Current Procedural Terminology (CPT) code

- The modifier number, if applicable

- A description of the service

- Your charge for the session

- The amount you collected

- Your signature

- Your license number

- Your Employer Identification Number (EIN) or Social Security number

- Your NPI

If the client has out-of-network coverage, they can then submit the superbill to their insurance plan and try to get out of network reimbursement. In an ideal scenario, the client's insurance would partially reimburse them. Encourage your clients to submit their superbills as quickly as possible, especially if they are counting on reimbursement or issues arise that need clarification.

3. Can an Out-of-Network Clinician Bill Insurance Directly and Bill Clients for the Remainder?

Yes, you can bill an insurance company directly and then bill your client for the remainder of the cost. Remainder billing means the client does not have to pay in full at the time of the service. For example, if a client has 50% out-of-network coverage, the insurance company will pay you 50%, then you bill the client the remaining 50% of the payment.

This billing method can be risky, however. In some cases, the insurance company may send the payout to your client instead of you, as that is usually the process with out-of-network providers. The client may also fail to pay their part of the bill, which could mean you do not receive full payment for your sessions.

4. What If the Health Plan Reimburses the Clinician Instead of the Client?

If you give your client a superbill and they submit the bill to their health plan, the health plan may inadvertently write you a check instead of the client. This could be a tricky situation. Though the simplest option may be to sign the check over to the client, the health plan may realize their mistake and ask you for the money back. If you have already given this money to the client, you could be in a difficult position.

Avoid signing the check over to the client or cashing it. Instead, the best solution is to have your client contact their insurance plan and alert them that they paid the wrong person. The client can then request that the payment stops or ask how to handle this situation.

5. What If a Client Only Wants a Receipt?

Sometimes, your client may simply want a receipt, not a superbill to submit to insurance. They may want this receipt for tax purposes, for example. While you can give a client information for their records, there is no need to include diagnosis or CPT codes. Instead, keep it general and create a business receipt showing the client paid for behavioral health services.

Contact Us at ICANotes

At ICANotes, we understand the increasing complexity of the healthcare environment has made your job more challenging than ever. We want to help you spend fewer hours creating documentation, give you peace of mind that your documentation will pass regulatory scrutiny and improve the content and legibility of your clinical documentation. If you are losing revenue because insurance companies are rejecting your claims or you are under-coding your notes, ICANotes can help.

ICANotes is ready to immediately make your behavioral health documentation comprehensive, sophisticated and fast enough to meet even the most stringent standards. Contact us at ICANotes to learn more about out-of-network providers or request your free trial of ICANotes today.